Companies have ramped up their pledges to increase diversity over the last few years, and while they largely may not see these programs as a risk, research shows there has been an uptick in litigation relating to diversity issues filed against U.S. companies since 2020. While experts highlight the many benefits companies reap from increasing… Continue reading Commitments to Diversity Are Increasing. So Too Is the Litigation.

Tag: Diversity

Three Factors That Are Organically Driving Board Diversity

The calls to diversify board leadership are justified for many reasons. First, it’s about time corporate leadership started looking like the rest of the employee base and the customers they serve. Second, diverse leadership can have a positive, cascading effect on inclusion and company culture. It has also proven to lead to better decision-making and more profitability.

The value companies are seeing from board diversity is not merely from the presence of a woman or person of color. Today’s newest board members bring different skill sets and commit more time to the job. More than any regulations, these needs are going to help improve representation on corporate boards in the years to come.

Friso van der Oord, senior vice president at the National Association for Corporate Directors, told Fortune that board turnover has gone up lately and he expects it to increase due the urgent need for board members with more free time and wider-ranging skills.

The emergence of ESG has also come through in recent board appointments, van der Oord shared. NACD analysis of MyLogIQ data found that the presence of board members with ESG backgrounds has doubled since 2018, from 6% to 12%, and HR or human capital nearly has as well, growing from 6% to 11% in their presence on boards. Those with technology expertise increased from 34% to 43%.

CEO Pay Increasingly Tied to Diversity Goals

The killing of George Floyd in police custody a year ago and the subsequent protests prompted pledges from U.S. business leaders: They would fight racism and work to recruit and promote Black and other minority employees.

Now, more companies are putting money behind those pledges by tying executive compensation to specific goals.

In January, Starbucks Corp. said it would give top executives more shares if the coffee chain’s managerial ranks grow more diverse over three years. McDonald’s Corp. in February gave executives annual incentives to increase the share of women and racial minorities in leadership roles by 2025. In March, Nike Inc. said it would for the first time tie some executive pay to five-year goals for improving racial and gender diversity in its workforce and leadership positions.

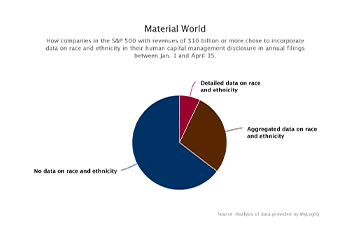

Scant Diversity Data in Human Capital Disclosures

Mentions of diversity are featuring prominently in companies’ human capital disclosures this proxy season; however, most companies are staying mum on the numbers. An analysis of 10-Ks filed by big companies by mid-April shows that only about a third disclosed any workplace demographic data on race and ethnicity. Fewer still broke the data out into specific demographic groups.

The new human capital management disclosure requirement was introduced by the Securities and Exchange Commission for the 2021 proxy season and requires companies to disclose material factors related to the management of the workforce. However, the SEC provided little guidance on what exactly companies should disclose, leaving it up to them to determine what would be material to investors.

Thus, the type of information disclosed so far varies widely. Some commonly included fields were global head count, regional representation of employees, employment contract type, collective bargaining agreements, staff turnover, components of employee compensation and wellness initiatives, among others.

…But only 35% of the companies disclosed data on racial and ethnic demographics according to an analysis of data from public company intelligence provider MyLogIQ.

Asian-American Professionals Push For Visibility at Work

Kaycee Lai spent years in Silicon Valley trying to avoid calling attention to his ethnic identity.

Early in his career, if he left work to get bubble tea, a Taiwanese drink, he’d tell his white colleagues he was getting coffee. When co-workers made comments about his race—such as suggesting that, as an Asian male, he should be in coding rather than sales—he would laugh them off.

“For the longest time, Asian-Americans have felt like you can achieve the American dream so long as you shut up and aren’t seen,” says Mr. Lai, who worked at Microsoft and software company VMware before founding his own data-analytics firm, Promethium, in 2018.

But amid a wave of outrage and sorrow prompted by a recent surge in verbal and physical attacks against people of Asian descent, that sentiment is changing among many Asian-American professionals. Since the Atlanta shooting last month in which six women of Asian descent were among eight killed, many Asian professionals have talked at company town halls about their experiences of racism and what it means to be Asian in U.S. workplaces and society. Some have pushed for donations from their employers toward issues facing Asian communities, while others have simply called for Asians to be more visible in the workplace.

…Among CEOs of S&P 500 companies, 3% are Indian and 2% are of other Asian descent, according to MyLogIQ, a data tracker.

Why Are There Still So Few Black CEOs?

If corporate life is a pyramid, for Black Americans, it is one with the steepest of peaks.

Out of the chief executives running America’s top 500 companies, just 1%, or four, are Black. The numbers aren’t much better on the rungs of the ladder leading to that role. Among all U.S. companies with 100 or more employees, Black people hold just 3% of executive or senior-level roles, according to Equal Employment Opportunity Commission data.

Decades after the civil-rights movement led to laws banning workplace discrimination, progress for Black executives has hit a ceiling.

“Opportunity is not equally distributed,” says Ron Williams, the Black former CEO of Aetna who has served on 14 boards over his career and currently sits on the boards of Boeing Co. and American Express Co. Too many promotions in companies are informally decided before jobs are ever posted, leaving Black people and more marginalized talent without the chance to compete, he says. “People don’t get the chance to work their way into a position where they are a reasonable candidate for a role,” he says.

…The ranks of Black chief executives have stayed low even as other ethnic minorities have seen greater, albeit still limited, advancement. Among CEOs of S&P 500 companies, 11% are ethnic minorities. Of the total, 3% are Latino, 3% are Indian, 2% are Asian, 1% are Middle Eastern and 1% are multiracial. Just 1% are Black, according to an analysis by MyLogIQ, a data tracker. Black people make up about 13% of the U.S. population.

Enforcement to ‘Hammer’ Diversity Laggards

While hundreds of California companies have moved to comply with the state’s women on boards law, the state has not penalized nor brought any enforcement against companies that have ignored aspects of it, from neglecting to file required disclosures to failing to recruit any women.

Additionally, the data that has been published by the office of the secretary of state appears to contain numerous discrepancies compared to companies’ public filings, according to a report compiled by public company intelligence provider MyLogIQ that examines the most recent data published by the state, and compares it with regulatory filings as of March 9, 2020.

Sources say the discrepancies illustrate some of the challenges in collecting data, and regulating and enforcing issues related to board composition. For instance, wellness and supplements seller Youngevity International was identified by California secretary of state Alex Padilla’s office as having complied with the law by having a woman on the board, Michelle Wallach. Wallach had been a board member since 2011 and served as chief operating officer of the company. She is also the wife of Youngevity chairman Stephan Wallach. However, in order to comply with Nasdaq listing rules requiring that the board comprise a majority of independent directors, Wallach and another director resigned on Feb. 13, 2020. Although she remains listed on the company’s website as a board member, she is no longer a director and the company has no women on its board.

‘Significant Movement’ in Adding Women to Boards

As states other than California contemplate board quota laws and federal regulators consider legislation concerning mandated board-level diversity disclosure, the women on boards law in California so far has led to an influx of new directors with backgrounds in finance and technology who also hold C-suite roles.

According to a new report from data intelligence provider MyLogIQ, which compared the California secretary of state’s March 2020 Women on Boards status report to public company filings, among the 330 California companies that filed 2019 disclosures with the state, 308 have at least one female board member and only 22 companies didn’t have women directors as of March. (See companion story, “Enforcement to ‘Hammer’ Diversity Laggards,” in this issue.)

Among the boards that have moved forward in recruiting women, the recruiting has added value, sources say. Some new female board members have also gone on to serve as committee chairs and lead directors.